Why Do You Need It?

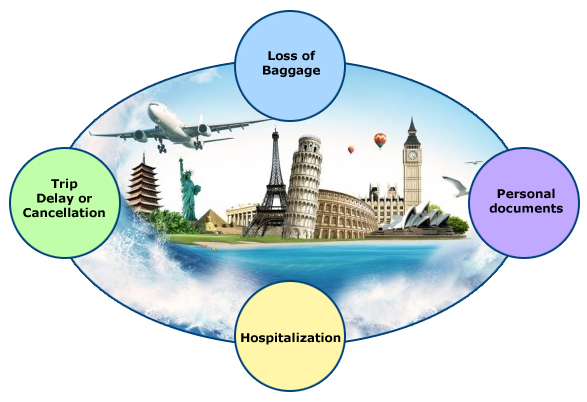

Traveling has become an integral part of our modern society. We could be traveling for reasons like a business trip or much awaited vacation. But one cannot deny the fact that there are several things that could go wrong when one travels. Disruptions like cancellation of flights, loss of baggage, medical emergency- are some of the unforeseen events that could catch you off guard. So whether you are off to your favorite destination for a holiday or going on a business trip - an adequate & complete travel insurance is a must have.

Types of Travel Insurance

Various plans are available according to every individual's travel needs.

1) Corporate Travel Insurance

Under this plan, employees of an organization can receive coverage for both domestic and international trips.

2) Domestic Travel Insurance

In this type, coverage is offered for death, medical emergencies, permanent disability, personal liability, delays, and lost/theft of checked-in luggage.

3) International Travel Insurance

It gives a comprehensive coverage for medical costs overseas, trip delays, loss of travel documents besides the regular coverage.

4) Senior Citizen Travel Insurance

This plan covers people in the age group 61-70 years. Besides providing general advantages, it also gives cashless hospitalization coverage and dental treatments.

5) Student Travel Insurance

This comprehensive cover is suitable for expenses incurred because of medical treatment, study interruptions and passport loss.

6) Individual Travel Insurance

Under individual travel plan, insured is covered against trip curtailment, trip cancellation and theft

7) Family Travel Insurance

It covers baggage loss, hospitalization expenses and other incidental costs. The claim disbursement is not difficult with less paperwork involved.

8) Multi Trip Insurance

This type of travel insurance is offered to frequent travelers so that they don’t have to apply for insurance every-time they travel.

9)Single Trip Insurance

As the name suggest, this type of cover is provided only for the duration of the trip. It also covers medical & non-medical emergencies along with baggage loss situations.

Key Features of Travel Insurance

1) Coverage offered for medical expenses.

2) Coverage for expenses related to trip delays

3) Coverage for loss of passport and luggage

4) For contingencies related to personal possession

Benefits of Travel Insurance

The basic worries of travellers include stolen baggage, lost passports, cancelled flights and trip delays. These mishaps can spoil perfectly planned vacations. Do not let such incidences ruin the entire journey.

Exclusions

1)Pre-existing conditions resulting to hospitalization

2)Damage or loss of keys

3)Trains or flights missed because of civil war/local protests

4)Luggage delay Expenses incurred because of civil unrest or local protests Customers should note that exclusions vary from one policy to policy.

FAQs Travel Insurance

What are the eligibility criteria for Travel Insurance?

From infants aged 6 months to 70 years old can avail of travel insurance

Are there any medical examinations involved?

No, there is no medical examination required upto the age of 70 years.

Is travel Insurance mandatory?

Travel Insurance is not mandatory in India. However it is mandatory in UK and countries like Austria, Greece, Portugal, Spain, France, Germany, belgium, Luxembourg, Netherlands.

However for a safe and peaceful trip, it is recommended that you take a Travel insurance policy even if you are travelling to countries apart from these.

Is passport loss covered in the travel insurance policy?

Yes, passport loss is covered in the policy. It is covered under the benefit of loss of Baggage and Personal Documents. The assistance provider helps in contacting the consular authorities in case of the loss or theft of an Insured Personal's passport, and arranging for its replacement.

What does loss of checked in baggage cover ?

This covers the insured person for the amount spent as cost of replacement of articles if checked in baggage is lost or demaged. The insured must keep the bills of such expenses for reimbursement

How much cover do I need?

Depends on the duration and your age. Longer stay abroad needs higher cover. Higher age would also demand a higher cover.